Photo by Valerie Everett, via flickr, CC BY-SA 2.0

When we think about household income, we usually think of annual income. Annual income totals are what we use to assess whether a household is poor, middle class, or rich. It’s how taxes are calculated. It’s how eligibility for a lot of programs, including housing and health insurance subsidies, is measured.

However, using an annual income measure builds on a hidden assumption: that income is mostly stable, regular, and predictable. For many households, income is all those things. But for many others, it’s anything but. We all know that income and expenses can fluctuate from month to month, but we tend to assume that the variability is negligible or at least predictable—perhaps nudged upward by a five-week month or a tax refund, or downward by unpaid leave, for instance. However, recent research indicates that American households have much more dramatic month-to-month income and expense volatility.

In other words, the amount of money they take in each month, and need to spend, varies. A lot. Increasing income and wealth inequality has received a lot of attention since the Great Recession. It’s shocking to see how the incomes of the top 1 percent or even the top 0.1 percent have risen in the last few decades. It’s perhaps even more shocking to learn that the top 1 percent of wealthy Americans own 35 percent of the nation’s total household wealth, while according to the Pew Charitable Trust’s Survey of American Family Finances, 41 percent of households didn’t have even $2,000 in liquid savings in 2015. These are historic and important inequities. But there is a third financial inequality that threatens to make these even worse, yet has received far less attention: inequality in accessing steady, predictable cash flows.

Volatile Incomes and Expenses

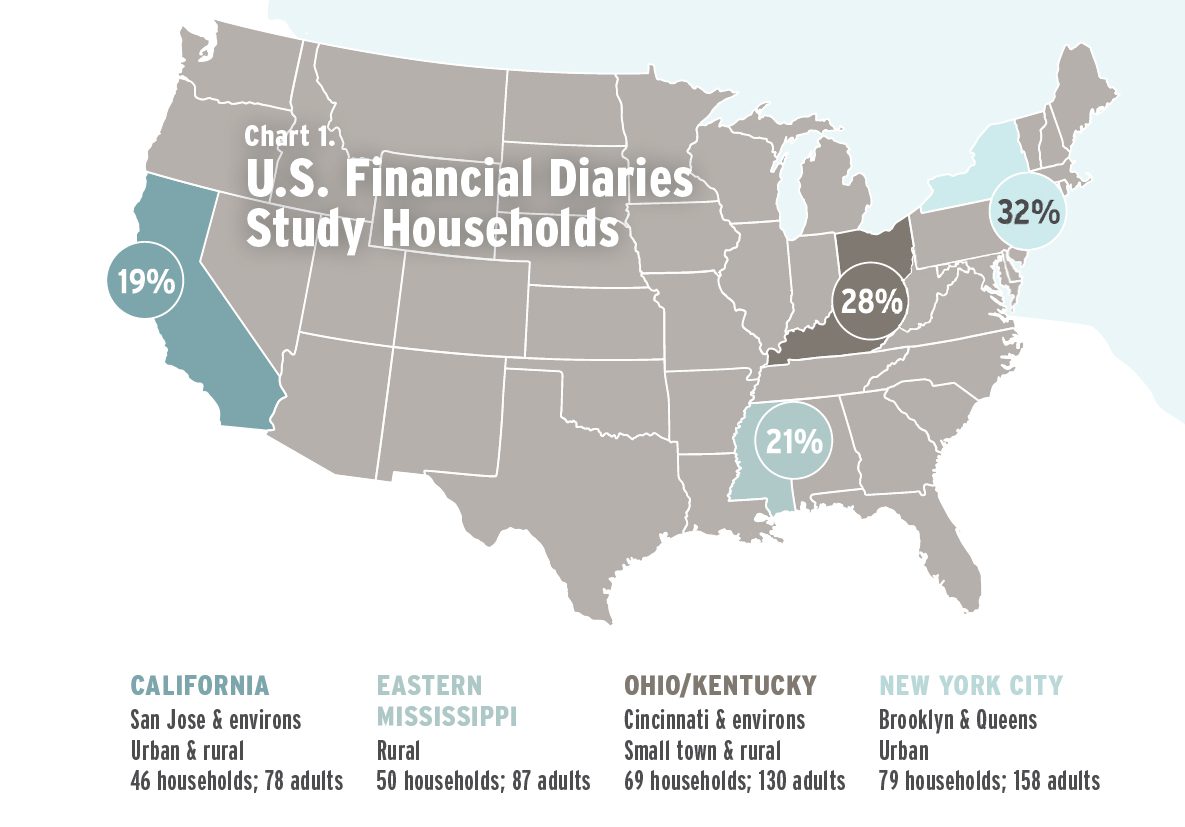

For the U.S. Financial Diaries project, we followed 235 lower- and middle-income working American households for a year thanks to funding from the Citi Foundation, the Ford Foundation, and Omidyar Network. We drew these households from four different locations around the United States—New York City, eastern Mississippi, greater Cincinnati, and south of San Francisco. We tried to record every dollar these households earned, spent, borrowed, and saved. Our research team got to know the participants closely; they learned about their attitudes and aspirations, their history, and their day-to-day lives. Some households were just below the poverty line, some well above it. Our sample was diverse but was not nationally representative. We aimed instead to understand the typical experiences of different kinds of working households.

Courtesy of the U.S Financial Diaries Project

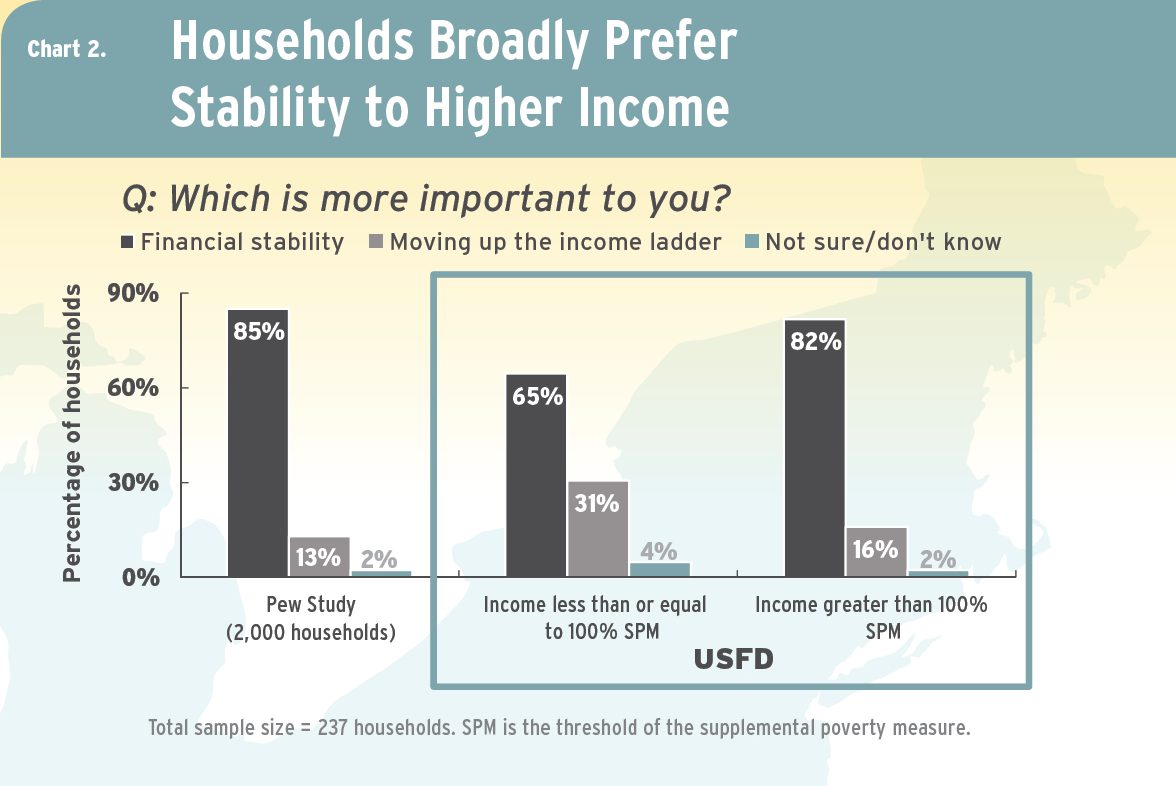

What we found was evidence of a lot of volatility within the year. On average, families in the study had more than five months a year when income was 25 percent above or below their monthly average. For example, a household making $36,000 a year isn’t necessarily making $3,000 a month. Based on our data, for more than five months a year, that family will earn less than $2,250 or more than $3,750. For participants who didn’t know how much money they’d earn from one month to the next, it was difficult to set a budget, plan for the future, or save for the long term. Volatile income can make it hard to qualify for credit on good terms. It makes it hard for lenders to determine how much debt a borrower can safely take on, and it can make qualifying for or maintaining public benefits a nightmare. Still, if it was just volatility of income that households had to cope with, that might be manageable. But anyone who has worked with low- and moderate-income households knows that expenses tend to be volatile, too. Cars break down, roofs leak, kids get sick. The U.S. Financial Diaries project revealed that a fundamental financial challenge for many families—regardless of the total amount of income they earn over a year or their total amount of savings or debt—is coping with times when expenses must be paid but income is not yet in hand. The diaries project made salient the critical distinction between not having money at the right time (illiquidity) versus never having the money (insolvency). If a higher income carries with it the same uncertainty and unpredictability, families would still face many of the same basic day-to-day challenges of illiquidity. In 2014, when Pew asked a nationally representative sample of households whether they would prefer moving up the income ladder or having greater financial stability, a shocking 92 percent said they would pick stability. Researchers from the Consumer Financial Protection Bureau explored how Americans define financial well-being, and they similarly found that what people most wanted was “control and confidence.”

Courtesy of the U.S Financial Diaries Project

It’s not that insolvency isn’t a problem. But too often, illiquidity is mistaken for insolvency, making it impossible to see fundamental problems and identify the best solutions. This research puts into sharp focus the fact that beliefs about how to achieve success in America are misaligned with the day-to-day realities of peoples’ lives. The story we tell about success is that slow and steady saving over a lifetime, combined with consistent hard work and a little luck, can ensure a solid financial life, a comfortable retirement, and better opportunities for one’s children. We allow for the possibility of a few upsets along the way, and encourage people to plan ahead for them. But spending time with the U.S. Financial Diaries families showed how challenging it is to get onto, or stay on, this type of steady path. The stories we heard and the financial lives we saw in rich detail showed that unsteadiness was now normal for many households. Volatility is hard to deal with for these families even when it is predictable volatility. In a world of income and expense volatility, many of the financial choices being made are smaller, but they are far more frequent and often more difficult. Short-term imperatives undermine long-term goals. Saving and borrowing need to be re-calibrated with each spike and dip in income and expenses. The stakes of each choice get higher. The consequences of bad decisions compound much quicker. The stress and anxiety make it all harder.

Coping With Volatility

How are households coping with this level of income and expense volatility? They aren’t helpless or hopeless, but they are struggling. Certainly many have had to develop complex strategies just to get by. But the biggest part of the story is savings. Based on statistics about American households’ dismal savings rates and how few families have emergency savings sufficient to meet the general guidance of financial advisors, it’s easy to think lower- and middle-income households are not saving at all. Given the volatility they face, it wouldn’t be surprising. That’s not what we saw. We saw families that were resisting the temptation to spend now, but not by locking savings away in a long-term account. They were saving a lot but not in ways that would show up in the typical survey about “savings.” Those surveys look at balances at one particular point in the year, or compare an end-of-year balance to total annual income. What we saw was lots of short-term saving. Families weren’t spending everything they earned as they earned it, but they also weren’t able to set aside money for more than a few months. When a spending spike came along without a matching income spike, they were forced to spend down their savings. And for obvious reasons, they tended to stay away from the long-term savings vehicles that policy and programs promote as the centerpiece of household finance. On average, households expected to spend 83 percent of bank account funds (regardless of whether it was stored in a “checking” or “savings” account) within the year. They were right. When households had a spending spike, they typically financed half of it by drawing down short-term savings. The median household deposited three times more money into their savings accounts in the course of the year than their year-end balance. When their short-term savings weren’t enough to cover expense spikes, households turned to friends and family for help, just as often as they used credit cards.

A New Approach

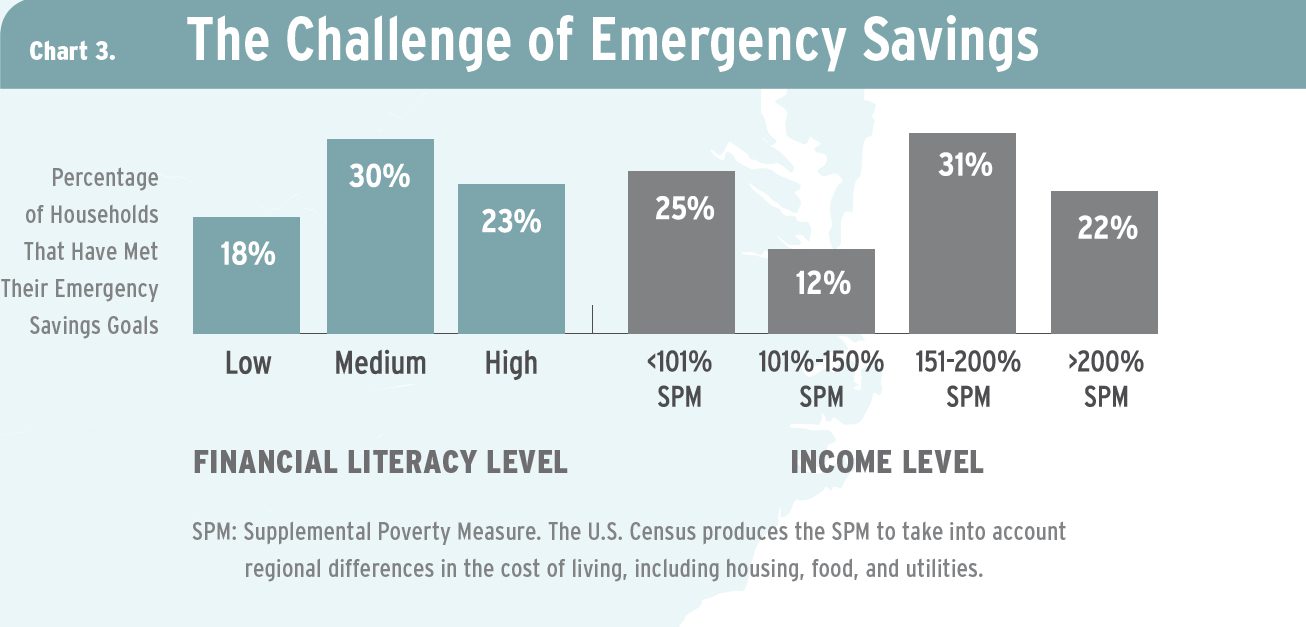

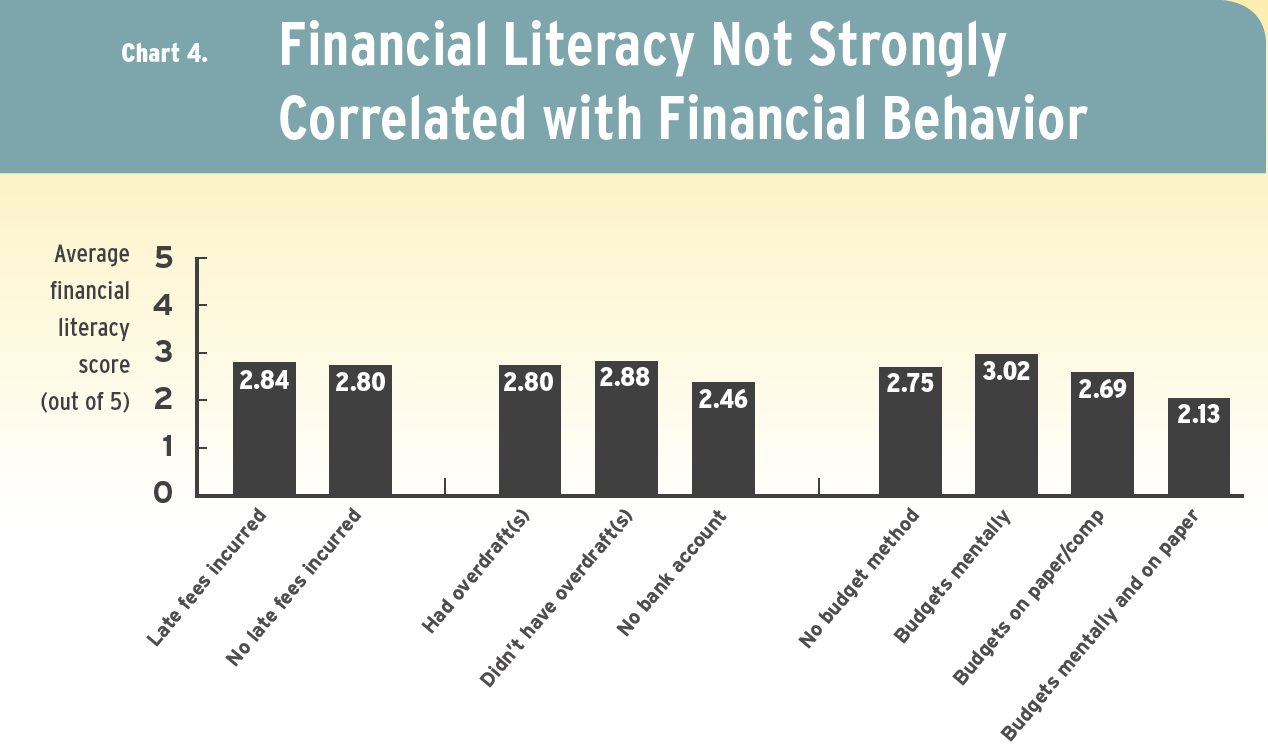

This research has led us to conclude that programs, polices, and products need to include a “third leg of the stool” that supports households and their aspirations. The War on Poverty initiated by the Johnson administration focused on income—raising the total amount that households took in. Beginning in the 1990s, there was a growing recognition that higher incomes were not enough; assets mattered, too. Even if households earned more, they were still highly vulnerable, and their upward mobility, particularly across generations, was permanently hampered without assets underpinning them. The U.S. Financial Diaries clearly show that cash flows matter just as much as income and assets. For many struggling households, the source of the problems they face isn’t whether they have “enough” money over the course of the year (they often do), but whether they have enough money on hand this month, even this week. That suggests fundamental changes to policies and programs. In a job with regular, stable paychecks, managing cash flow is mostly a question of budgeting and resisting the temptation to spend now. In fact, that’s what most financial advice and financial literacy curriculums focus on. This set of ideas underpins such policies as IRAs and Individual Development Accounts, which provide incentives for saving for the long term, and include withdrawal penalties to reinforce those incentives. The challenge the diaries families faced wasn’t resisting temptation in the short-term in favor of long-term savings. It was figuring out how to survive the frequent and regular mismatches created by volatile incomes and expenses.

Courtesy of the U.S Financial Diaries Project

Financial literacy for these households isn’t about understanding compound interest. In the U.S. Financial Diaries study, we don’t see any systematic effect of financial literacy on households’ behavior or situation. For instance, once we control for a households’ overall income and education, those with higher financial literacy did not have higher levels of emergency savings nor did they have higher goals for emergency savings. The general evidence on financial literacy training bears out this observation—the most rigorous studies consistently fail to find much evidence that financial literacy training changes behavior, even when there is an effect on financial knowledge.

Courtesy of the U.S Financial Diaries Project

But households do need help managing volatility. The help they need, however, is about making a budget when income is 25 percent above or below the average for nearly half the year. How do you plan when 25 percent or even 50 percent of your annual income arrives in one lump sum in February? What if the financial choice you have to make isn’t which IRA offers the best investment choices, but which pawn shop offers a better deal when you need cash to pay the electric bill and keep the lights from going out? When do you pick up extra hours at work to have a bit of extra cash? Is it better to pay down your credit card balance or build up the rainy day fund?

Another major area that needs innovation is housing policy and programs. The shortage of affordable housing makes many financial challenges even harder to deal with. Ellen Seidman, an expert on housing issues and a member of our advisory board, recently wrote about rethinking programs to help households find stable housing. Income volatility, and the constant spending down of short-term savings, is obviously a challenge to building up a lump sum for a downpayment. But it’s also an issue for qualifying for a mortgage in the first place, since borrowers typically need two years of stable income.

For that matter, how do you calculate a reasonable debt-to-income ratio if income is so volatile? For both owners and renters, volatile income doesn’t match up well with the need for regular payment. A major source of expense volatility we saw among Diaries households was falling behind and catching up on rent and mortgage payments. Households would often skip a month or two of payments, then when income spikes, spend much of it to get current again. These are just some of the issues we saw households facing. They are issues that are increasingly common for a wide swath of American families. And those issues are major barriers to households’ financial stability and upward mobility. It’s clear that we need new products, programs, and policies designed for the actual financial lives and choices that American households face today.

Comments