But as important as those are, they aren’t the full picture: for quite a while, researchers and advocates have been telling us that it will also take changing the disparity in assets, not just income. Assets are an important counterweight to income because they provide a cushion that allows households to survive emergencies and changes of circumstance, as well as giving them a platform from which to invest in longer-term goals. As Alexandra Bastien put it on Shelterforce’s blog last year, “Income is how you get out of poverty; assets are how you stay out.”

We’ve been writing in Shelterforce about these issues since at least 1996, shortly after Michael Sherraden proposed the idea of “individual development accounts, matched savings for asset-building purposes. And the ideas of the value of asset-building and the racial assets gap come up constantly in conversations about how much we should be prioritizing homeownership, for whom, and how.

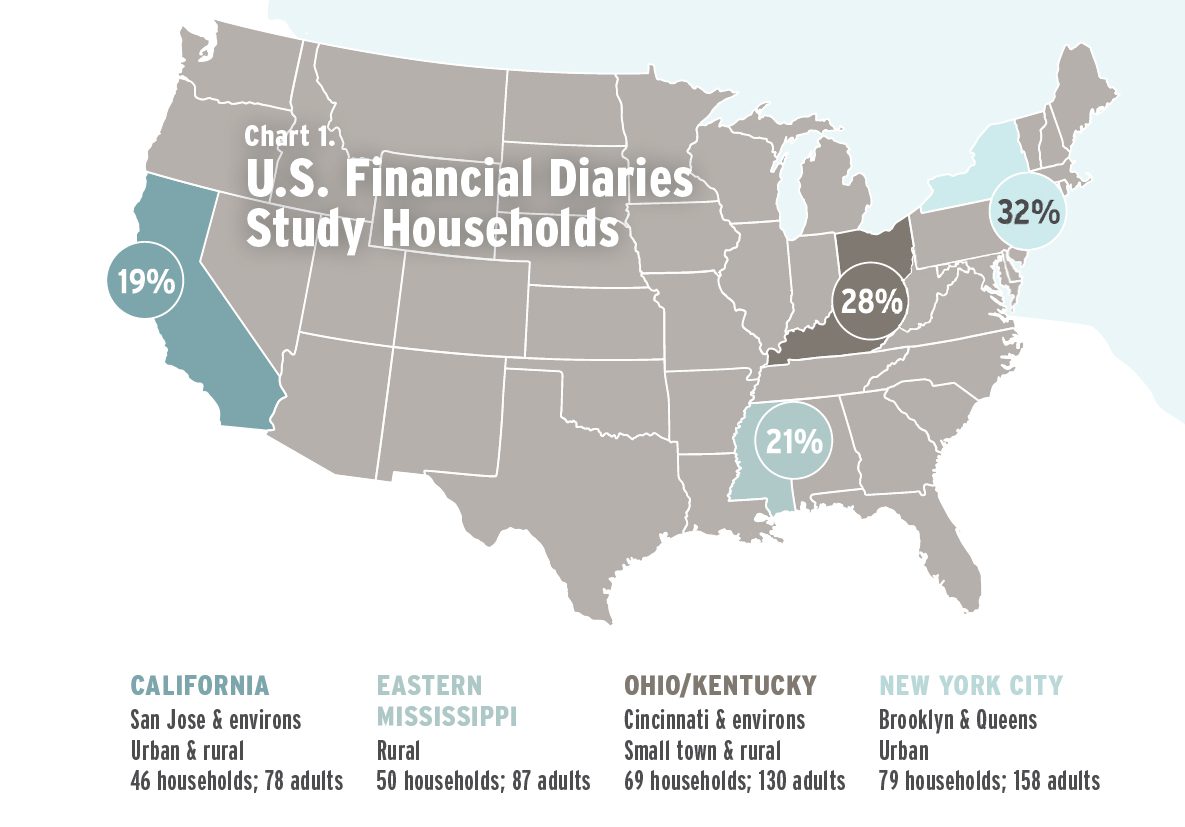

Meanwhile, financial well-being goes beyond income and assets. Research from the U.S. Financial Diaries project shows that financial instability—unpredictable and widely fluctuating income and expenses—is actually a major challenge for American families all on its own. It affects the ability to plan and save, as well as susceptibility to predatory financial products that can steer vulnerable households into vicious cycles. I found it incredibly striking that both Pew Charitable Trusts and the USFD found that low-income households would choose financial stability over higher income; that’s how much volatility wreaks havoc with family finances. USFD researchers propose that financial well-being be considered a three-legged stool composed of income, assets, and cash flow.

In a world with increasing income inequality, less stable employment, skyrocketing tuition costs, vastly more complex financial products, and relentless marketing, the meaning of financial well-being and how we can advocate for it is shifting and we decided it was time to devote an issue of Shelterforce to these questions. In this issue we tackle perceptions that asset-building is mostly about behavioral change for low-income households (see here, here, and here), explore the problem of income volatility (see here, here, and here), look at structural issues that reproduce financial instability (see here and here) and talk about some solutions and campaigns (see here, here, and here). If you’re intrigued by these topics and want to know even more, check out our review of What It’s Worth, a book of essays published by CFED and the Federal Reserve Bank of San Francisco; and check out our ongoing online coverage.

Also in this issue, we say goodbye to Sheila Crowley, former president of the National Low Income Housing Coalition with an interview from April, just before she stepped down after 19 years in that role. As always, Crowley encouraged us to keep our eyes on the prize of improving housing stability and affordability for those in the most need, and talked with us about what it took to make the gains the coalition has made toward that goal, even while economic circumstances increase the need.

Crowley also spoke of organizational stability in the face of funding trends, which is a salient topic for many organizations these days. Community developers reliant on developer fees are getting nervous as tax credits become harder to get and federal funding shrinks. In our focus issue on the CDC model, there was a lot of discussion about the proper scale of housing development, and the ways in which locally based community developers could and should adapt. In this issue, we revisit these questions with a close look at some of the ways local organizations are diversifying their programs and revenues. (Spoiler alert: none of them are giving up on developer fees.) This article is the second in our New Frontiers in Community Development series, generously sponsored by Citi Community Development.

As community developers diversify their toolboxes and strategies, one place they have been turning increasingly to is arts and culture. One of the many ways community organizations can support arts-based revitalization is to support local artists in plying their trade and gathering an audience, whether by providing venues, community, or business support. Tamara Holmes introduces us to several groups that are taking this approach. Read more arts-related content.

As always, share your experiences with, or opinions on, any of these topics in the article’s online comments sections or at [email protected]. Do these articles match with what you see in your work, or do you have another perspective on them?

Comments